From the table you can see that direct materials are the integral part and a significant portion of finished goods. Examples include advertising costs, salaries and commission of sales personnel, storage costs, shipping and delivery, and customer service. Fluctuation of costs is yet another challenge that makes it harder to calculate manufacturing costs accurately, according to Fabrizi. The next step is to calculate the costs of utilities (electricity, water, or gas) that are directly used in the manufacturing process (for example, fuel used to operate the production equipment).

Managerial Accounting

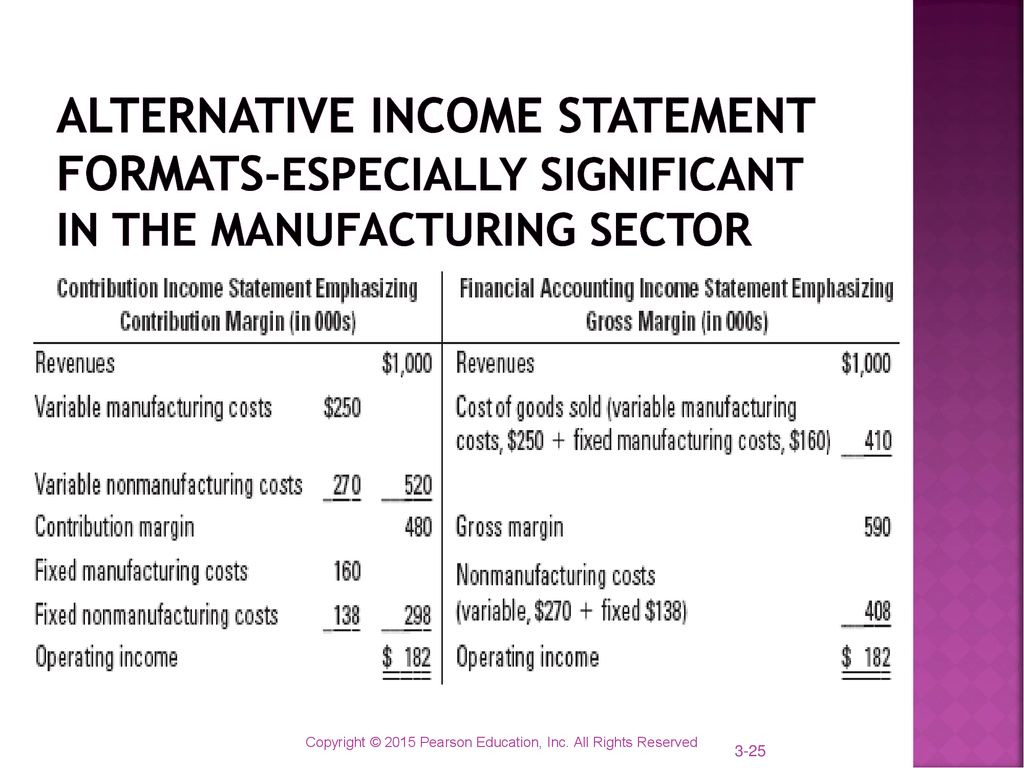

Manufacturing costs initially form part of product inventory and are expensed out as cost of goods sold only when the inventory is sold out. Non-manufacturing costs, on the other hand, never get included in inventory rather are expensed out immediately as incurred. This is why the manufacturing costs are often termed as product costs and non-manufacturing costs are often termed as period costs. Examples of direct materials for each boat include the hull, engine, transmission, carpet, gauges, seats, windshield, and swim platform. Examples of indirect materials (part of manufacturing overhead) include glue, paint, and screws. Direct labor includes the production workers who assemble the boats and test them before they are shipped out.

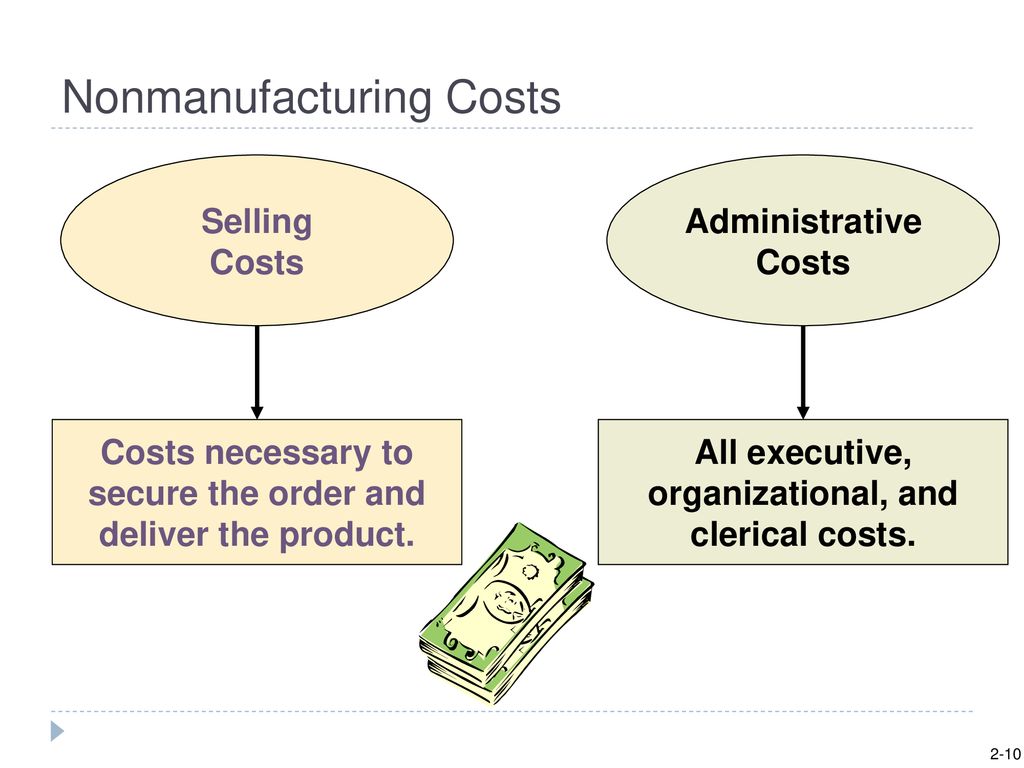

What are Nonmanufacturing Overhead Costs?

In general, overhead refers to all costs of making the product or providing the service except those classified as direct materials or direct labor. (Some service organizations have direct labor but not direct materials.) In manufacturing companies, manufacturing overhead includes all manufacturing costs except those accounted for as direct materials and direct labor. Manufacturing overhead costs are manufacturing costs that must be incurred but that cannot or will not be traced directly to specific units produced.

What Is the Definition of Manufacturing Overhead Budgets?

- To obtain these details, you can refer to the company’s employment records that has a list of all the employees and their hourly rates.

- For accounting purposes, nonmanufacturing costs are expensed periodically (typically in the period they are incurred).

- The products in a manufacturer’s inventory that are completed and are awaiting to be sold.

- Each table is unique and built to customer specifications for use in homes (coffee tables and dining room tables) and offices (boardroom and meeting room tables).

Direct labor costs include the wages and benefits paid to employees directly involved in the production process of goods or products. Accurate cost calculation helps companies identify the processes or materials that are driving up manufacturing costs and determine the right pricing of products — the keys to remaining profitable. In this example, the total production costs are $900 per month in fixed expenses plus $10 in variable expenses for each widget produced. To produce each widget, the business must purchase supplies at $10 each.

However, if management wants to determine the profitability of a specific product or customer, it is necessary to allocate or assign nonmanufacturing costs to the products and/or customers outside of the financial statements. In the end, management should know whether each product’s selling price is adequate to cover the product’s manufacturing costs, nonmanufacturing costs, and required profit. Selling expenses are costs incurred to obtain customer orders and get the finished product in the customers’ possession. Advertising, market research, sales salaries and commissions, and delivery and storage of finished goods are selling costs.

Nonmanufacturing Overhead (Explanation Part

Next, calculate the value of the existing inventory if the manufacturing company already has a stock of materials from a previous period. When you add up all these direct costs, you get the Cost Of Goods Sold (COGS), a term used in accounting when preparing the company’s financial statement. Note “Business in Action 2.3.1” details the materials, labor, and manufacturing overhead at a company that has been producing boats since 1968. Table 2.3.1 provides several examples of manufacturing costs at Custom Furniture Company by category.

Each of them requires a different set of cost control measures, making appropriate cost categorization even more essential. For instance, if the manufacturing costs are too high, these costs can create a dent in the company’s profit. In this case, the management can decide to stop the production of some goods and invest in developing new ones that have a lower cost of production.

For instance, if some raw materials are driving up costs, manufacturers can negotiate with other suppliers who may be willing to supply these materials at a lower cost. Fabrizi also talked about the common challenges manufacturers face when calculating the costs of production. In his experience, the most common challenges are a lack of accurate data amortization business and the complexity of costing methods. After manufacturing product X, let’s say the company’s ending inventory (inventory left over) is $500. Then, add up the cost of new inventory — this is the cost of raw materials you purchase to manufacture the product. Manufacturing costs, for the most part, are sensitive to changes in production volume.

Small, inexpensive items like glue, nails, and masking tape are typically not included in direct materials because the cost of tracing these items to the product outweighs the benefit of having accurate cost data. These minor types of materials, often called supplies or indirect materials, are included in manufacturing overhead, which we define later. That part of a manufacturer’s inventory that is in the production process and has not yet been completed and transferred to the finished goods inventory. This account contains the cost of the direct material, direct labor, and factory overhead placed into the products on the factory floor. A manufacturer must disclose in its financial statements the cost of its work-in-process as well as the cost of finished goods and materials on hand.

While carrying raw materials and partially completed products is a manufacturing cost, delivering finished products from the warehouse to clients is a period expense. Sometimes it is difficult to discern between manufacturing and non-manufacturing costs. For instance, are the salaries of accountants who manage factory payrolls considered manufacturing or non-manufacturing expenses? Therefore, businesses typically establish and adhere to their own criteria. Once you identify the indirect costs, get detailed expense data for each of these overhead cost categories for a specific period, such as a month or a year. You can track expenses by looking at your invoices, receipts, and records of all expenditures related to manufacturing overhead.