Best try to begin with situated within the 2014, and also the business shines in the audience given that a modern-day substitute for a complex techniques. The whole financial process is accomplished online when you favor Greatest, which means you don’t need to run home financing associate otherwise head to a workplace really.

If you find yourself Most useful doesn’t give some situations, such HELOCS otherwise Virtual assistant finance, the cost are quite lower, as a consequence of investor-coordinating technical. Subsequent, Greatest acquired significantly more than-mediocre customer satisfaction score out of J.D. Electricity. Eventually, moreover it has actually the common star score out of 4.thirteen of 5 stars among over 1,100 customer studies shared with brand new Better business bureau.

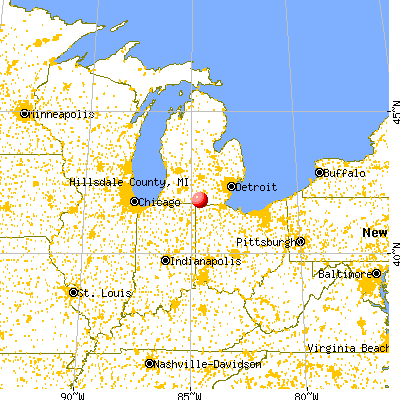

United states Coupons Lender (NASB) try to begin with founded in 1927, while the providers preserves their headquarters from inside the Kansas Town, Missouri. They have because the grown becoming a major seller of numerous financial situations, including Va funds to have eligible armed forces users and veterans.

NASB also provides numerous home loan assistant software targeted to very first-time homeowners too, including a program called Property Virtue and a no Off Home loan Program. The company now offers a seamless online financial processes on choice to display screen your loan using an on-line dash and you can upload your called for records as a result of its portal.

After you negotiate a successful promote into the a house you want to order, North american Deals Bank also provides personalized guidance to greatly help book you from the https://paydayloancolorado.net/akron/ process.

Experts Joined Mortgage brokers Perfect for Va Loans

Pros United Lenders is a very rated mortgage company one to is targeted on Virtual assistant home loans, which can be only available to experts, certain effective-duty military, and you will being qualified spouses. Such financing enable you to qualify for some of the low financial costs on the market today which have simple qualification standards. Borrowers may use their Va financial advantage to pick good domestic or to re-finance on the home financing with ideal prices and words.

Veterans United in addition to boasts some of the finest reviews of the many financial enterprises from inside the J.D. Power’s 2022 U.S. No. 1 Home loan Origination Fulfillment Research.

Indeed, it scored 905/step 1,000 you’ll be able to factors, getting next destination just trailing USAA. Pros United including has the average star score out of cuatro.82 regarding 5 celebs all over more than step 1,900 studies distributed to this new Bbb, where business is qualified with an a+ score.

Citibank Home loan Perfect for Citibank Customers

Citibank is renowned for the checking and you may savings accounts also as its most readily useful credit card also offers, but this financial now offers some mortgage factors. Not merely can it promote purchase money for people that are looking for yet another family, but inaddition it now offers refinance funds to possess property owners who want to trading its home loan to own a different that that have most useful conditions.

The business allows users would the majority of the financial process on the internet, also where you could qualify for a beneficial $five hundred credit in the their mortgage closure. In addition it promises timely pre-approval with its SureStart system, which can help you safe a package into a property when you create a deal.

Citibank even offers occasional advertisements for the mortgage products, and that ount of your own closing costs and lower rates of interest having established Citi users.

NBKC Financial Best for Backed Money

NBKC are in the first place centered during the 1999 because Federal Bank of Kansas Area, the business has changed the appeal in order to online banking as their beginning. The lending company currently centers on sponsored funds, as well as Virtual assistant money getting armed forces participants, veterans, and you can eligible relatives.

During-individual customer care is obtainable simply during the Kansas and you will Missouri, the bank’s cellular phone support produces its functions accessible to people during the every fifty says. NBKC as well as guarantees a completely on the internet mortgage software processes, even if you need to talk to an agent to track down a speeds quote according to their house’s worth and where you alive.