Are you aware you could safer a mortgage even while into an income-dependent installment plan for their student loans? Indeed, lenders feel the eco-friendly white to look at the payment amount significantly less than certain money-motivated repayment preparations – whether it’s IBR, ICR, PAYE, or REPAYE. So it calculation plays in the debt-to-money ratio to possess traditional mortgage loans, if Federal national mortgage association otherwise Freddie Mac backs it or if it is a federal government-supported financing throughout the FHA otherwise Virtual assistant.

Well, until recently, it had been. Pre-pandemic, consumers saddled having high mortgage balance must carry out quite the brand new controlling work to help you secure home financing.

This is actually the dated techniques: button off a keen IDR propose to one that develops their student mortgage debt more ages. This plan generally speaking resolved – particularly for my website subscribers which have federal student education loans.

Their simply road send was to scout getting refinancing opportunities with a different lender in hopes away from less rate of interest and you will longer payment name – and therefore remains the condition quo today. Remember that you want good credit and good money to discover the best re-finance pricing and words.

However, why don’t we commemorate the tiny wins: underwriting direction took a switch towards the best. Now, homebuyers strained with beginner financial obligation can inhale a sigh regarding rescue. Making use of their payment number according to the IBR plan to rating an excellent real estate loan recognition is a much smoother ride.

Federal national mortgage association Old-fashioned Home loan

They truly are ok having IBR costs. Its assistance believe which you document fees position having a card statement or mortgage statement. Even when your own payment was $0, they will certainly bring it. Remember for papers appearing it’s zero.

Freddie Mac Traditional Financial

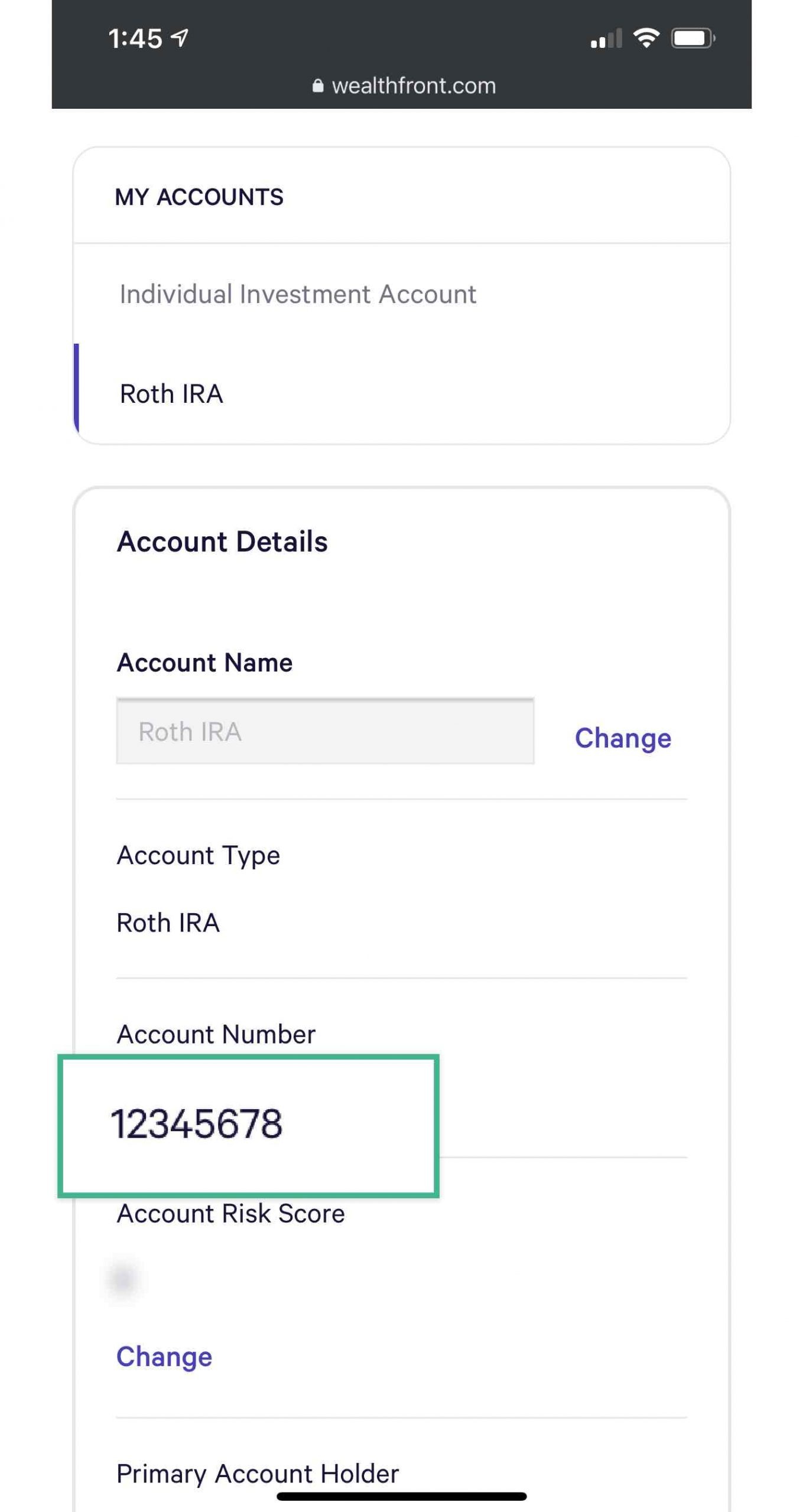

These are typically flexible regarding IBR repayments, nevertheless the Freddie Mac computer student loan recommendations are certain. If the monthly IBR fee isnt stated on your credit statement or perhaps is detailed just like the deferred or perhaps in forbearance, Freddie Mac demands additional documents to confirm this new monthly payment number having calculating your debt-to-income ratio.

Suppose no payment try said for the a good deferred otherwise forbearance education loan, no records on your own home loan document suggests this new proposed monthly percentage. Therefore, 1% of one’s a good mortgage equilibrium could be thought while the month-to-month number to own qualifying objectives.

Paperwork could include an immediate confirmation on the collector, a duplicate of your financing contract, or even the estimated percentage expected once deferment otherwise forbearance comes to an end, due to the fact found on your own financing certification https://paydayloancolorado.net/simla/ or arrangement.

Despite zero alterations in Freddie Mac’s provider guide, we’ve got obtained lead verification from their website: They are going to consider carefully your IBR commission whenever determining the debt-to-money proportion. Thus, should your IBR commission try $0, 0.5% of a great financing harmony, while the reported on your own credit history, could well be utilized for DTI computations.

FHA Mortgage

The newest FHA laws keeps altered as per Mortgagee Letter 2021-thirteen. The fresh FHA education loan guidelines now wanted and additionally all beginner funds about borrower’s debts, no matter what new fee kind of or standing.

Whether your percentage used for the newest monthly obligation is less than brand new monthly payment advertised towards borrower’s credit history, the new mortgagee need to get composed papers of genuine payment per month, commission condition, a good balance, and terminology from the creditor otherwise education loan servicer.

The brand new commission amount advertised towards credit report and/or genuine noted payment if payment amount was a lot more than no

Va Mortgage

The brand new Virtual assistant demands lenders to use the mortgage payment number towards your credit history for the DTI. But if one commission falls lower than a particular endurance, you will need to render an announcement from your education loan servicer discussing the true financing terms. The newest endurance are determined if you take 5% of your own an excellent loan balance and you will separating they by the several.

USDA Mortgage

Disappointed, no IBR fee having USDA. Its signal guide determine your own payment need to be totally amortized or use 0.50% of one’s a good financing harmony given that revealed on the credit file or perhaps the most recent reported fee less than a payment plan approved by this new Company away from Degree.

The latest Advancements

For the white of latest proposition regarding President Biden’s management, these statutes may see certain transform in the future. The new earnings-centered cost package proposes to limit monthly payments during the 5% of your own earnings to own undergraduate loans, which may after that effect your own DTI data.