Everybody knows you will be designed to has good credit to track down an effective loan. But what are good borrowing from the bank, and how much does it impression your loan overall? Even though your credit rating isn’t the merely monetary metric used to determine how your mortgage try prepared, its an important facet along the way.

What is actually a good credit score and how can it feeling their cost?

Your credit score signifies your own creditworthiness and you will suggests loan providers the danger they will certainly assume once they approve you for a financial loan. Loan providers can imagine their level of upcoming borrowing from the bank risk mainly based for the early in the day conclusion and view just how most likely you are to repay financing.

Reasonable Isaac Firm (FICO) are a data analytics business you to definitely works out your credit rating created to your suggestions on your credit reports. Very lenders make use of your FICO rating whenever deciding once they would be to approve you for a loan.

New rating is not a predetermined number and you can varies periodically when you look at the reaction to alterations in their borrowing craft. Data is utilized from all of these four kinds so you’re able to estimate their FICO score:

Credit ratings include 300 and you can 850. In which you fall in which diversity will establish simply how much away from a danger you are in order to a loan provider. In case the credit history expands, the exposure height erica are 711, and you will a good credit score is payday loan Sugar City ranging from 670-740.

Your credit rating truly influences the mortgage interest rate. You can get acknowledged for a loan that have a variety from credit ratings and you may down-payment combos. But the higher your credit score was, the greater favorable their interest might possibly be.

Lenders have confidence in credit ratings to suggest exactly how probably a debtor is to try to repay a loan completely. When loan providers is actually sure a debtor will pay the borrowed funds totally and on date, might charge less interest rate.

When you yourself have less credit history, you might still be capable of getting accepted for a loan. Although not, the financial institution tend to fees increased interest rate to make sure a beneficial go back to their currency.

The difference on the credit history alone might cost $ a lot more per month and $67,576 also living of one’s financing.

Your credit score including has an effect on the cost of your own financial insurance policies. If the advance payment was below 20 percent, you have to has actually individual financial insurance rates (PMI). PMI can cost you are normally taken for 0.5 per cent and you will step one.5 per cent of the loan amount. Whether your credit score was lower, you will be using a higher PMI count.

Tough and you may smooth credit inspections

Silky borrowing monitors are a in your borrowing from the bank who has got zero influence on their rating. Once the a mellow glance at doesn’t alter your credit score, you could done one as much as required.

A challenging credit score assessment happens when a financial institution monitors your own credit making a credit decision. A hard examine will lower your rating by a number of facts and you may remains in your credit report for as much as 24 months.

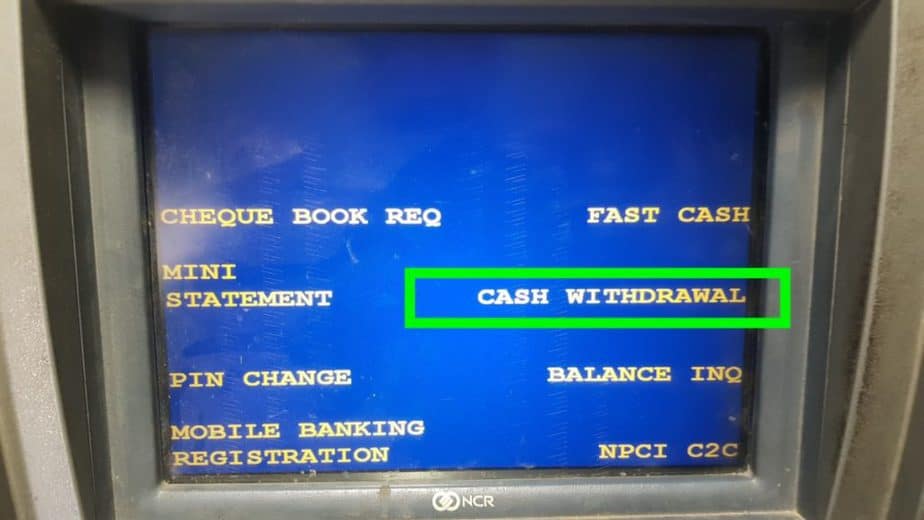

At the Semper Lenders, you can discovered an excellent pre-recognition to see how much cash you might use and the pricing your be eligible for by the completing a softer credit check.

If you’ve currently filled out an official mortgage app, so it does wanted an arduous credit check. But not, immediately following a painful evaluate is taken, you have got forty-five months to complete multiple credit monitors with out them impacting your credit rating.

How to alter your credit history

There’s no incorrect for you personally to work towards increasing your borrowing from the bank get. However some some thing bring time for you to eliminate from your own borrowing from the bank accounts, there are numerous actions you can take first off improving the borrowing now.

Generate costs timely. Commission background ‘s the largest cause of deciding your credit score, this is why and come up with prompt repayments is so important. Set a system in position to eliminate late payments whatsoever will cost you.

- Perform a magazine otherwise electronic program to keep track of month-to-month bills

- Set notification getting payment dates,

- Automate statement repayments from your own lender

Don’t maximum your levels. Do not use more 29% of the readily available spending limitation in your handmade cards.

Keep earliest borrowing from the bank levels discover. Dont intimate older lines of credit when you pay them away from. This may raise your borrowing from the bank utilization ratio and you can impression the borrowing score.

Seek mistakes on your credit report. Consult a copy of one’s credit file regarding around three significant credit agencies: Experian, Equifax, and you will TransUnion. You might be eligible to a free of charge credit file out of each one of the firms one time per year. According to another type of analysis from the Individual Account, 34% away from customers reported looking one error within their borrowing records.

Correspond with that loan officer otherwise implement on the web

If you have questions relating to your credit rating and you will exactly what costs your qualify for, reach out to a loan officer each time to discuss just what mortgage suits you. You can also begin the job on line now.