- Limited Worth The latest upgrades you add to your residence you’ll increase the really worth exponentially. You will only be capable of getting financing for what its really worth thereon day. Meaning you cannot pick a dump house and you can borrow funds up against they.

- Designers Degree Each person that actually works towards house you are to purchase must be certified of the Veteran’s Administration. Meaning they understand which advice shall be accompanied for the generate to make sure that the brand new Va is not responsible for people difficulties otherwise crashes.

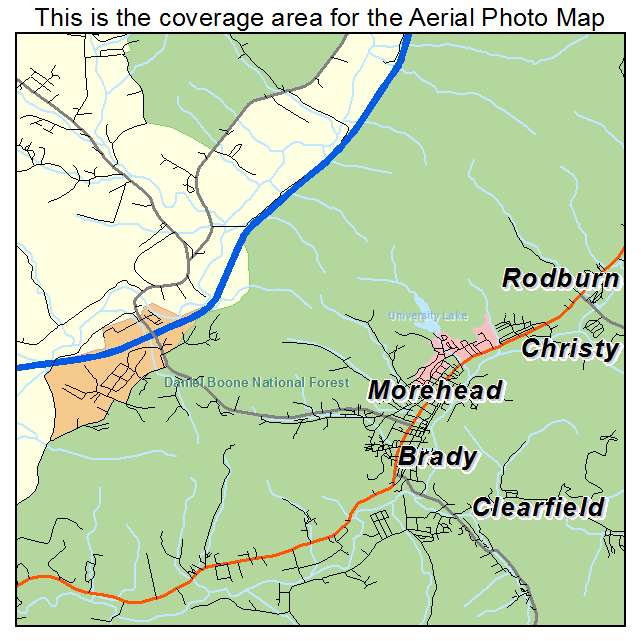

Away from common qualifications hoops to diving as a consequence of, there are also things, installment loans Virginia such as for example location, which will keep customers of obtaining the mortgage. If you live outside of the continental United states, you might be in for an impolite waking.

- Surviving in Alaska or Hawai’i The brand new Va likes to remain all their qualities for the components into the new continental All of us. That implies if you’d like to real time the newest regarding-grid lifestyle for the Alaska or perhaps from inside the a seashore household into the Hawai’i, you’ll have to prefer an alternative location to make the fantasy become a reality.

- Credit rating You should have no less than an excellent 640-mortgage get before bouncing into procedure. If not, i don’t have far you can do. The financing rating as well as your DD214 will be the brand new most critical areas of that it entire process.

Your or your spouse’s sacrifices whenever you are providing this excellent nation try not likely to be neglected. New Virtual assistant ensures that experts in addition to their spouses have the full-weight of its gurus, and that translates to the purchase therefore the future renovations together with designers make use of.

Is Virtual assistant Interest rates A number of the Reasonable Acceptance on Field?

The newest Va is recognized for having the greatest pricing towards domestic fund. For example, utilizing the Renovation financing, you get the lower price into family in addition to the bucks, up to $100k, during the low speed industry will allow. This means during your financing; it will save you thousands.

Often the reduced-interest is exactly what drives the latest household toward Va mortgage. It gives a family an additional level of income that can be taken for the something different crucial, instance homeowners insurance. The reduced-interest-rates would be regarded as money spared along the lifetime of your own loan rather than in order to features a beneficial shorter home commission.

Brand new No cash Down Choice Assists Thousands of Household Each year

The fresh Virtual assistant Restoration loan come with a no money off choice you to definitely no one more now offers. The possible lack of money makes the mortgage book and you may helps make the Va truly the only company that will verify 100% of financing.

Into the vet to receive the brand new no money down part of the borrowed funds, they must possess the ideal credit score. The brand new down-payment doesn’t merely are available; it is extended along side longevity of the loan and you will can add on several cash every month toward financial.

Is actually Financial Insurance coverage Expected When deciding on the Va Repair Loan?

Making use of the Va Recovery financing helps you save of being forced to purchase insurance policies. Almost every other lenders you are going to require you to enjoys an extra insurance rates count added to the borrowed funds you to definitely protects financial institutions from standard. Funds protected of the pros try covered against standard by Va.

Mortgage insurance can add on thousands of dollars to home financing. Naturally, without having to invest the insurance are a method to save your self currency, but you need to look during the putting you to more income on the getting particular better-tier home insurance.