To invest in property inside Nj can seem to be instance a constant race. An average cost of a property is actually $428,890. In the past three years, homes prices possess enhanced from the 16%, additionally the markets reveals no signs and symptoms of closing. There are more buyers than households inside their budget, making it possible for home loan enterprises are choosier on who qualifies and you will just what interest the buyer will have.

A credit history are a description off exactly how fiscally in control good body’s. It offers lenders which have a goal, analytical technique for comparing the likelihood that a person will pay the amount owed. It selections away from 350 to 850 which can be will regarded because an effective FICO rating (named following design used to calculate they). Something below 600 is considered high chance to own lenders, when you’re a rating of 601 so you’re able to 649 is regarded as high-risk. A FICO score out of 650-699 implies specific risk and you can a rating of 700 to 750 was lowest risk. A score off 750 to 850 is considered shallow chance.

Breaking down the latest Compilation of a credit rating into the Nj-new jersey

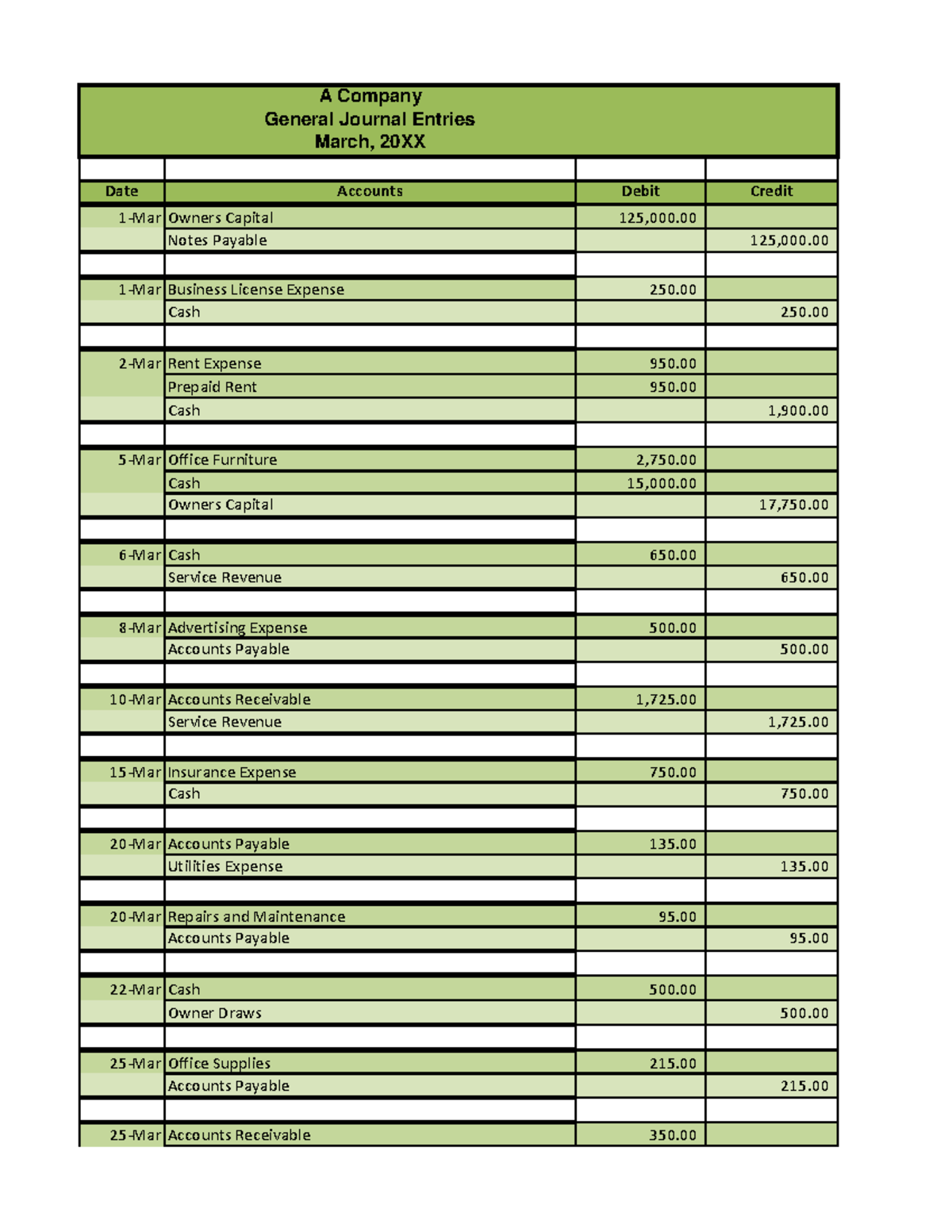

A credit history try a compilation various circumstances related to someone’s financial responsibility. Fee reputation of tools, playing cards, and finance compensate 35% of the score. All sorts of accounts, including savings, currency ined and you will given a percentage of ten%. If you have several issues concerning your borrowing from the bank, including obtaining an auto loan, this new handmade cards, or some other the fresh new credit line, 10% of credit history would go to you to. The new issues will remain in your record for a couple of many years also in the event the credit is not obtained. Along your credit report was fifteen% of score. It is valuable to show an ability to manage credit securely in the place of later payments or earlier in the day-owed profile. A good stability is tasked 29% of your own credit history. A great harmony is when far borrowing from the bank available out of the credit notes otherwise funds youre currently paying. Revolving borrowing from the bank are account instance handmade cards, if you’re payment borrowing try funds. For example, if you have a few playing cards with a $cuatro,000 limit and personal loans for bad credit Washington purchases totaling $step 1,000, you’ve still got plenty of readily available credit. A student-based loan have a tendency to lower your available earnings it is an enthusiastic example of the readiness to invest expenses timely. Although not, you’ve got a lesser FICO score for individuals who just have $500 regarding readily available borrowing, even if you spend the expenses timely because you play with the majority of your readily available credit.

Mediocre Minimal Credit rating You’ll need for home financing

An average minimum get to have home financing try 620. Depending on the form of mortgage you are obtaining, you need increased get, while some provides all the way down criteria. Your credit score is beneficial, but it is you’ll be able to to do business with the rating you really have to get the domestic you have always wanted.

Perception out-of Credit rating on the Qualification to possess home financing

If you need home financing, the bank uses your credit score to see how well you handle your finances and you can bills. It reflects your once the a borrower, nevertheless get doesn’t color the whole visualize. The individuals points won’t necessarily operate into hindrance if you are using bucks or provides a small credit score because of many years. Your credit score will become necessary but not truly the only equipment utilized to measure the capability since a debtor. That is why lenders make use of credit rating and you will credit history. An excellent credit history produces a difference even though your own rating isnt so great.