In lease situations, the lessor uses the residual value as one of its primary methods for determining how much the lessee pays in periodic lease payments. As a general rule, the longer the useful life or lease period of an asset, the lower its residual value. To appropriately depreciate these assets, the company would depreciate the net of the cost and salvage value over the useful life of the assets. If the assets have a useful life of seven years, the company would depreciate the assets by $30,000 each year. Both declining balance and DDB require a company to set an initial salvage value to determine the depreciable amount. An estimated salvage value can be determined for any asset that a company will be depreciating on its books over time.

What Is the Loss for Tax Value?

It refers to the future value of a good (typically the future date is when the lease ends). In accounting, residual value refers to the remaining value of an asset after it has been fully depreciated. Salvage value, also known as residual value or scrap value, is the estimated worth of an asset at the end of its useful life. It’s a critical component in calculating depreciation and can significantly impact financial statements and tax calculations. Book value is the historical cost of an asset less the accumulated depreciation booked for that asset to date. This amount is carried on a company’s financial statement under noncurrent assets.

Double-Declining Balance Method

When an asset has reached the end of its useful life, it may still have value in its individual components or as scrap. Companies can sell these parts or scrap to recover some of the asset’s value, thus reducing the overall cost of ownership. This method estimates depreciation based on the number of units an asset produces. In the example, the machine costs $5,000, has a salvage value of $1,000, and a 5-year life.

How Is Salvage Value Calculated?

So, salvage value is the money a company expects to make when they get rid of something, even if it doesn’t include all the selling or throwing away costs. There’s also something called residual value, which is quite similar but can mean different things. Sometimes, it’s about predicting the value of the thing when a lease or loan ends. Other times, it’s about figuring out how much it’s worth when it’s done for good, minus the cost of getting rid of it.

Factors Affecting Salvage Value Calculation

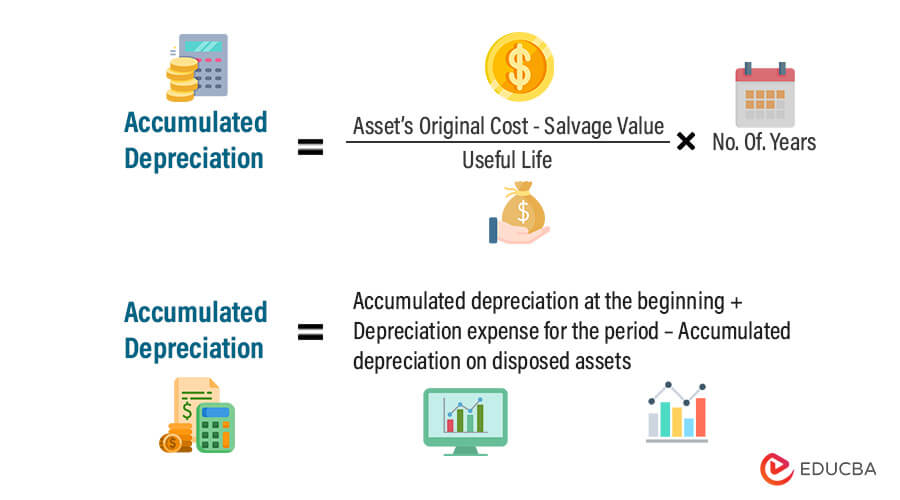

The value of the asset is recorded on a company’s balance sheet, while the depreciation expense is recorded on its income statement. Salvage value, also known as residual value or scrap value, is a fundamental concept in accounting and asset management. It refers to the estimated value that an asset will have at the end of its useful life. Understanding how to accurately calculate salvage value is essential for businesses to manage their assets effectively. Accountants use several methods to depreciate assets, including the straight-line basis, declining balance method, and units of production method. Each method uses a different calculation to assign a dollar value to an asset’s depreciation during an accounting year.

The level of maintenance and upkeep performed on an asset throughout its lifespan can affect its salvage value. Proper maintenance and regular upkeep can help preserve an asset’s condition revolving funds for financing water and wastewater projects and functionality, increasing its salvage value. On the other hand, neglected or poorly maintained assets may have a reduced salvage value due to their diminished condition.

Many companies use a salvage value of $0 because they believe that an asset’s utilization has fully matched its expense recognition with revenues over its useful life. Companies determine the estimated after tax salvage value for anything valuable they plan to write off as losing value (depreciation) over time. Each company has its way of guessing how much something will be worth in the end. Some companies might say an item is worth nothing (zero dollars) after it’s all worn out because they don’t think they can get much.

In order words, the salvage value is the remaining value of a fixed asset at the end of its useful life. Technological advances can significantly impact the determination of salvage value. As new and more efficient technologies emerge, older assets may become outdated and less desirable in the market. This can lead to a decline in their salvage value as buyers prefer assets with the latest technological capabilities.

- Depreciation expense is then calculated per year based on the number of units produced.

- This method involves obtaining an independent report of the asset’s value at the end of its useful life.

- At this point, the company has all the information it needs to calculate each year’s depreciation.

Moving on, let’s look through the details of how the salvage value can be used in depreciation calculations. By the end of the PP&E’s useful life, the ending balance should be equal to our $200k assumption – which our PP&E schedule below confirms. The salvage calculator reduces the loss and assists in making a decision before all the useful life of the assist has been passed.

Residual value and resale value are two terms that are often used when discussing car-purchasing and leasing terms. Using the example of leasing a car, the residual value would be a car’s estimated worth at the end of its lease term. Residual value is used to determine the monthly payment amount for a lease and the price the person holding the lease would have to pay to purchase the car at the end of the lease. In some contexts, residual value refers to the estimated value of the asset at the end of the lease or loan term, which is used to determine the final payment or buyout price. In other contexts, residual value is the value of the asset at the end of its life less costs to dispose of the asset. In many cases, salvage value may only reflect the value of the asset at the end of its life without consideration of selling costs.

How much the desk is worth at the end of seven years (its fair market value as determined by agreement or appraisal) is its residual value, also known as salvage value. This information is helpful to management to know how much cash flow it may receive if it were to sell the desk at the end of its useful life. The difficulty in calculating residual value lies in the fact that both the salvage value and the cost to dispose of the asset may not truly be known until disposition. Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important component in the calculation of a depreciation schedule. You can use it for estimating the remaining value of an asset at the end of its useful life.