Are you presently a seasoned otherwise productive-duty solution member looking to buy a home, but i have no credit history? The fresh new Va mortgage system is a fantastic selection for people that provides served the country and tend to be trying to homeownership. Yet not, of numerous might think that which have no credit rating disqualifies all of them off an effective Va financing.

This web site article have a tendency to talk about ways to get a good Virtual assistant financing and no credit direct lenders for bad credit installment loans Florida rating. We will also have techniques for efficiently using.

Va loans can help you achieve your homeownership hopes and dreams. Performing or reconstructing the borrowing? This informative article demonstrates to you how Va lenders review credit score.

Exactly what are the Great things about Virtual assistant Mortgages?

Virtual assistant finance are a kind of mortgage loan which can be found to help you veterans and you can effective-duty solution players. The latest Va guarantees the borrowed funds. This decreases lenders’ chance, causing them to likely to approve they.

Virtual assistant loan applications commonly need no deposit. This will make them far more popular with army users and you may pros who has got minimal the means to access cash. As well, there is no monthly private mortgage insurance (PMI) specifications with your variety of finance.

An additional benefit would be the fact Va finance typically have all the way down interest rates than the antique money. This might help save you many over the course of the loan payment period.

It is important to notice regardless if; just because you will be entitled to a beneficial Va financing does not always mean you happen to be automatically accepted. You nevertheless still need in order to meet certain borrowing criteria and provide evidence of income and possessions.

Va funds offer many benefits to help you experts and you may active-responsibility solution professionals. You don’t have people down-payment getting Virtual assistant fund and you usually do not even you want a vintage credit score. For these reasons, Virtual assistant loans are usually better to get than simply Old-fashioned finance.

Do you know the Va Mortgage Credit rating Requirements?

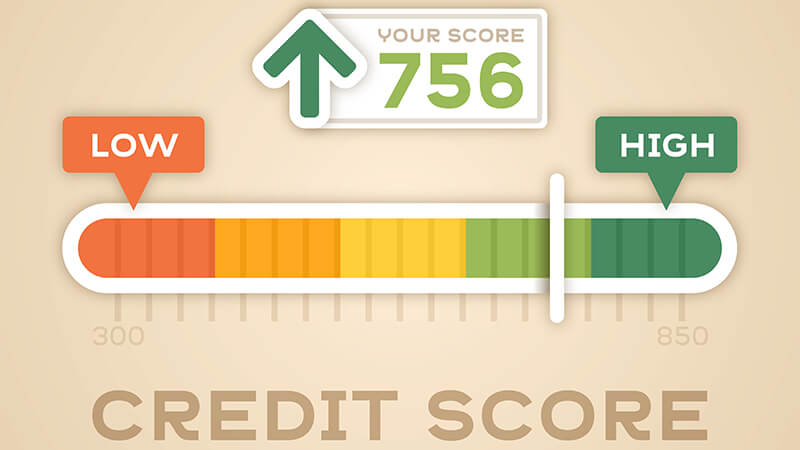

Your credit score is actually determined according to your credit report and you will commission records. High credit ratings can be better than lower scores. Your credit rating goes down for those who have later payment, choices and other derogatory borrowing.

One of the first products you to definitely lenders believe whenever looking at a great borrower’s credit history is your credit rating. Essentially, extremely Va loan providers favor individuals with a minimum credit rating away from 620 if not 640. However,, HomePromise has accepted Va money that have good 580 credit score.

HomePromise are working to track down a means to approve you regardless of if you really have a reduced credit history. We shall get acquainted with the borrowing choices through the years. We’re going to take a look at one bad situations and you may remark your own factors having those people bad incidents to see if approval is possible.

It is critical to observe that the fresh Agency of Veterans Facts really does not have lowest credit score criteria. However,, really loan providers set their unique Va loan credit rating requirements. Sooner, it is the bank which find if you meet the requirements.

HomePromise often think about your entire monetary photo, in lieu of specific Virtual assistant loan providers. These firms tend to require at least credit rating of 640 otherwise 620.

Can i Score An excellent Va Loan and no Credit history?

With a beneficial credit history is essential when trying to get a good Virtual assistant financial. It is most frequently the newest deciding cause of one’s qualification. Most other choosing facts is actually higher credit ratings and you may demonstrating proof income within the last 12 months.

But, if you have no credit rating, it does not suggest youre disqualified regarding taking a great Virtual assistant financing. You might still be eligible that have HomePromise.

New Agencies from Experts Factors (VA) knows that specific veterans will get be unable to build the borrowing from the bank. That is due to deployments otherwise a desire to prevent getting into financial obligation. Many armed forces participants and you can pros find it difficult to get approved having playing cards throughout their obligation.

The latest Virtual assistant now offers different alternatives of these obtaining an effective Virtual assistant loan. This includes individuals with no mainly based credit rating. But, certain Va lenders restriction these Va finance and can turn experts off and no credit rating.

For those who have zero credit score, you may think such as for example providing a great Va mortgage is actually hopeless. But, HomePromise features borrowing from the bank remark techniques that will get around new burden of getting zero credit score.

Wise considered and preparing are fundamental. This new Virtual assistant mortgage benefits during the HomePromise is also make suggestions from the process. Telephone call now on 800-720-0250.

No Credit score Va Financing Is You’ll That have HomePromise

Individuals with zero credit history have an option. They’re able to offer what is known as an option financial record (otherwise records), such book costs or power bills. This will be a valid solution to show your Va lender facts out-of a monetary record.

These data demonstrate debt reliability they direct you are capable of repaying expense punctually. So it reassures Virtual assistant loan providers. This is actually the kind of research you need to qualify for an effective Virtual assistant financing no credit score.

Another option worth considering gets a non-experienced co-debtor who has got based a robust credit score. This person takes mutual obligation with you when repaying the debt and you will serve as proof of your financial accuracy.

HomePromise can help you browse new Virtual assistant loan application techniques. This will enhance your believe whenever obtaining a Virtual assistant financing with less than perfect credit or no borrowing.

Tricks for Whenever Applying for Good Virtual assistant Mortgage with no Borrowing Background

By the contacting HomePromise, you could potentially successfully submit an application for a good Virtual assistant mortgage even after no credit history. Although not, you can find even more ideas to bear in mind for the app process:

Possess an explanation able to possess why you have no credit score. We are going to want to know the reason. Be sure to will be ready to give an explanation for your disease.

Think providing an excellent co-signer: If possible, imagine trying to find an individual who is actually prepared to co-to remain the loan. Having a beneficial co-signer with a good credit score can increase your chances of approval and you may help you get most readily useful financing terms.

Dont get several loans on top of that. This may reduce your likelihood of acceptance and you will adversely effect their upcoming credit history. Follow HomePromise and make sure your see all of their standards just before distribution a software.

While you are acknowledged for a great Va mortgage without credit score, focus on strengthening your own borrowing throughout your the fresh Va financing . Be mindful having almost every other the latest borrowing making payments on the day.

Taking an excellent Va loan without credit score might need efforts. But not, it is really worth the effort since it setting purchasing your perfect domestic without worrying in the highest down repayments otherwise PMI.

Make use of these suggestions to plan new HomePromise software process. This may bring you one-step closer to homeownership. Call today in the 800-720-0250.

Virtual assistant Debt consolidating Financing & Army Debt consolidating

Even after the very best of purposes, expense will start to help you accumulate. Out-of unexpected scientific bills so you’re able to higher focus playing cards, personal debt may appear so you can someone. Almost every other expenses such as for instance expenses, unpaid taxes, and you can 2nd mortgages may also trigger monetary be concerned. For veterans and you will army family currently feeling financial difficulties, Virtual assistant army debt consolidation finance may help.