During the highest-rising prices numerous years of the brand new later 70s and you can 1980s, Cds had return pricing out-of nearly 20%. After that brand new Computer game pricing , in advance of this new cost savings spiraled downwards, they were at around 4%. In contrast, an average that-season Cd yield is below 1% within the 2021. It gradually improved in 2022, getting over 5% inside the 2023 and you can 2024 on account of ascending inflation. Regarding U.S., the latest Federal Reserve, and therefore controls federal loans prices, calibrates them appropriately in line with the economic climate.

Ways to use Cds

Dvds are effective financial instruments in terms of protecting deals, strengthening short-title riches, and you may making certain efficiency without risk. With our trick professionals in mind, you’ll be able to take advantage of Cds that with them to:

- complement varied profiles to minimize total risk coverage. This can come in handy just like the retirees score nearer to its senior years go out and need a more secured come back to be sure it possess offers inside senior years to call home off.

- act as a primary-identity (5 years otherwise less) location to place more money this is not expected otherwise isn’t necessary up to a-flat coming time. This will be useful when protecting to have a deposit having a property or vehicles years later.

- estimate coming yields precisely because most Dvds has fixed costs. The consequence of that is a helpful investment for those who choose predictability.

Because readiness big date having an effective Video game steps, Cd customers features options of what direction to go next. More often than not, in the event that there is nothing complete pursuing the maturity time, the money are reinvested towards a separate equivalent Video game. Or even, you’ll be able to own customers to alert the suppliers so you’re able to import the money to the a monitoring otherwise family savings, otherwise reinvest for the yet another Computer game.

Withdrawing off a Computer game

Finance which might be invested in Dvds are meant to feel tied right up into the life of the new certificate, and you will people early distributions are typically susceptible to a punishment (but h2o Dvds). The seriousness of the latest punishment utilizes the size of the newest Video game and giving establishment. Just like the an away, in some ascending rate of interest environments, it may be economically good for Cokedale CO payday loan alternative spend the money for very early withdrawal punishment in order to reinvest this new proceeds with the the newest higher-producing Cds and other expenditures.

Video game Ladder

While you are stretched-name Cds promote higher returns, a glaring disadvantage in it is the fact that the money was secured right up for extended. Good Video game steps is a type of means utilized by investors that attempts to prevent it disadvantage that with numerous Dvds. In place of renewing a single Cd having a certain amount, this new Computer game are divided into numerous wide variety for numerous Dvds into the a build which allows these to mature from the staggered intervals. Like, unlike expenses all fund into a great step 3-season Video game, the money are widely used to purchase step 3 different Dvds at the once that have terms of 1, dos, and you can 36 months. As one grows up, and also make dominant and money offered, continues are going to be optionally reinvested to your another Cd or withdrawal. Computer game laddering should be of good use whenever much more freedom will become necessary, by providing a person entry to in earlier times invested fund within a lot more frequent menstruation, or even the capability to buy new Cds at higher costs in the event that rates rise.

APY versus. Apr

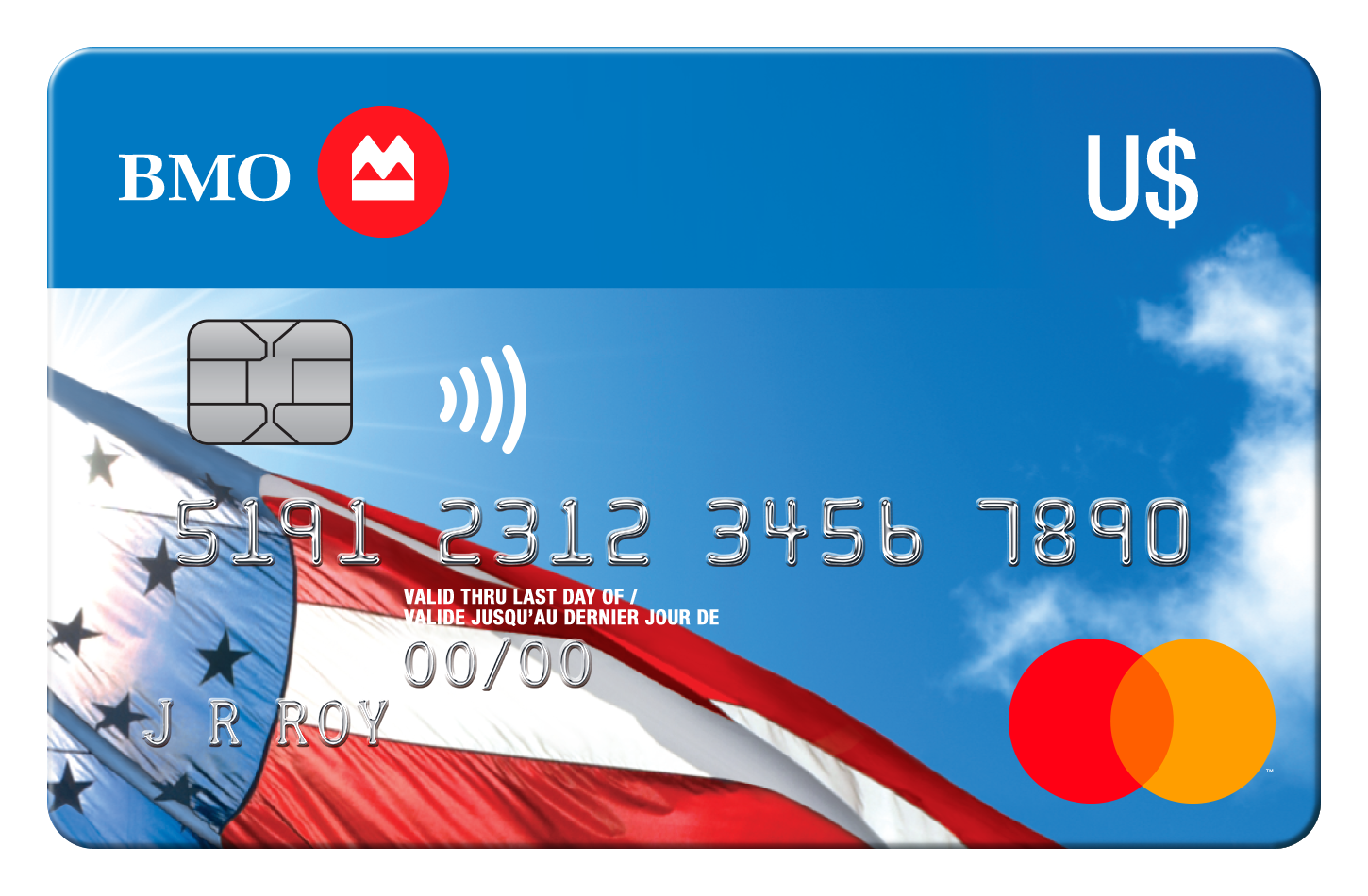

It is vital to make the distinction between yearly percentage yield (APY) and you may annual percentage rate (APR). Banks commonly explore Annual percentage rate having financial obligation-related levels instance mortgage loans, playing cards, and you will auto loans, while APY can be about focus-accruing account for example Dvds and money ount of interest received which have compound focus taken into account when you look at the a whole 12 months, if you are Annual percentage rate ‘s the annualized icon of your month-to-month interest rate. APY is usually the greater accurate symbolization away from active net growth otherwise losses, and you can Dvds usually are said for the APY pricing.