Highlights:

- First-date family visitors loans are available to borrowers that have never ever bought an initial house. They might additionally be open to consumers exactly who satisfy certain other standards.

- Financing one to commonly interest very first-go out homeowners include bodies-supported FHA, Va and you will USDA funds, and down-payment direction applications.

- Actually versus being qualified to own authorities-recognized funds and other unique advice, first-time homeowners can still do it to secure an inexpensive financial with a terms.

Buying personal loans Michigan your very first family can be a costly, nerve-wracking techniques. Thank goodness, amateur customers can imagine a variety of sensible funds. This type of loans usually are a lot more offered to basic-big date customers than you possibly might think. They might also be a good idea for:

- Solitary moms and dads who before simply had a home which have a former partner.

- Individuals who have previously owned a property unfixed to a long-term base, such a cellular or are built family.

- Individuals who had a property which had been perhaps not up to building rules and may also not delivered to password at under the total amount it can cost to build another type of permanent framework.

You can be eligible for unique funds, gives and other positives whenever you are a low- or middle- money visitors, whenever you are a current or former armed forces service member or if you are searching to purchase in certain geographical metropolises.

The particular standards one to homebuyers need certainly to satisfy differ regarding financial so you’re able to lender. So make sure you opinion your options cautiously.

Kind of financing for first-time homebuyers

There are many different variety of loans right for basic-day homebuyers, although down-payment standards or any other terms and conditions are very different. Many options also render financial help.

Old-fashioned mortgages

The expression old-fashioned mortgage identifies people mortgage it is not insured from the U.S. government and other teams. As a result when your borrower defaults into loan, the lender can find on their own at a loss on harmony to the financial.

Conventional loans commonly bring straight down interest rates and higher complete words than many other brand of financing. Yet not, such masters started at a price: Since the conventional funds angle a high chance in order to loan providers, they may be harder so you’re able to be eligible for and also stricter borrowing standards than many other selection. It’s not impossible for a primary-time homebuyer to help you qualify for a traditional home loan, however, government-recognized loans is going to be a lot more accessible.

FHA money

In the event your credit history is around 620, you’ve got problem protecting a traditional financial. This is where bodies-backed money are located in. Particularly, FHA loans is backed by brand new Federal Houses Government. Because your financial has security whether or not you are struggling to pay off your balance, FHA money incorporate a whole lot more easy credit standards than just of numerous traditional finance.

FHA money generally speaking want a credit score with a minimum of 580 getting approval, considering you might agree to a beneficial step three.5% downpayment. But not, if you possibly could manage an excellent 10% down payment, you are able to qualify for an FHA financial which have a credit rating as little as five-hundred.

The newest disadvantage to it the means to access is the fact FHA financing need individuals to pay for private home loan insurance coverage (PMI). PMI superior make it possible to refund the lending company if the debtor defaults on their financing. PMI is often paid from the lifetime of the loan and would-be computed once the a certain percentage of your legs loan amount.

Va finance

The U.S. Department out of Experts Things (VA) provides usage of funds getting basic-date homeowners while some who are active-responsibility military services players, experts and enduring spouses.

With this particular form of financing, the Virtual assistant partially claims mortgages out-of a private bank. It means individuals discovered money with ideal rates, lower settlement costs, far more good terms and you may – in many cases – zero downpayment. Virtual assistant money are generally excused of expensive PMI. The main downside to these funds is that qualification is limited in order to borrowers with a connection to the armed forces.

USDA money

The latest You.S. Service away from Farming (USDA) even offers special fund to have reasonable- and you can middle- earnings outlying homeowners using their Rural Innovation program.

For those who have a method earnings, you ily Casing Guaranteed Financing System. Since this types of mortgage emerges of the a medication personal lender but backed by government entities, consumers normally discover alot more favorable words. When you find yourself a minimal-money debtor, you may also qualify for the lowest-costs loan directly from brand new USDA, as well as temporary mortgage repayment guidelines. Earnings eligibility for programs varies by state.

USDA money are only available to homeowners thinking of buying a beneficial household within the discover outlying section. You might refer to the brand new USDA’s qualifications chart for more information regarding qualifying cities.

Rescuing to possess a deposit are going to be prohibitively expensive for the majority of first-go out homeowners. Condition and you may regional homes agencies offer different DPA programs to help relieve so it load to own earliest-big date homeowners.

DPA apps have different conditions, nonetheless they essentially assist by the layer all otherwise much of your deposit and settlement costs. Certain, for example DPA 2nd mortgage loans, are paid back over time. Others, and 0% attract deferred-fee fund, need to be paid down only when you refinance their home loan or offer your residence. Certain software may even promote zero-strings-attached DPA grants.

Certification differ from the area, Thus consult your local property agencies to see if your satisfy their demands to possess recommendations.

Even if you never qualify for DPA or other unique guidance, you can nonetheless do so in order to safer an inexpensive mortgage with advantageous terms and conditions.

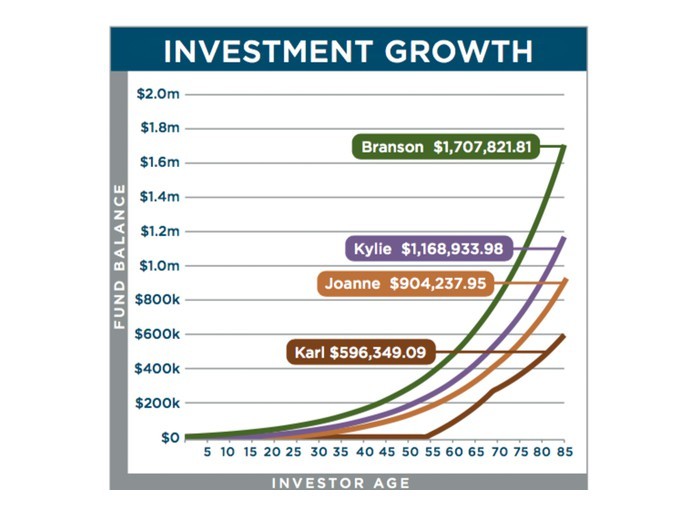

- Sit in your spending budget. Lay a resources predicated on your earnings and you can stick to it using your family lookup. You shouldn’t be afraid so you’re able to reduce what you’re searching for, particularly if you will be worried about a pricey mortgage.

- Reduce your loans-to-earnings (DTI) proportion.Your DTI is short for the amount of loans repayments your debt monthly split by the terrible monthly income. So it proportion is usually referenced by lenders given that a way of measuring your capability to repay that loan. Lenders generally promote mortgage loans on greatest terminology and you will low focus costs so you can consumers having DTIs regarding thirty-six% otherwise all the way down. To alter your DTI, you’ll need to often pay down the debt or improve monthly earnings.

- Save your self to have a much bigger advance payment. Of several mortgages need a downpayment with a minimum of 20% of your own house’s sale rate. For those who have higher credit ratings, you have got certain self-reliance in the way much you ought to pay upfront. However, loan providers We should your down-payment are below 20%, working to struck you to mark will be one good way to all the way down your general will cost you.

- Keep an eye on your credit file and score. Lenders comment the credit ratings overall foundation whenever comparing your financial app, and also to place their interest rate or any other mortgage terms and conditions. Your credit scores or any other items, like your income, may also change the amount of money your qualify for.

Sign up for a credit monitoring & Identity theft safety tool today!

To have $ 30 days, you could understand where you’re having accessibility your step 3-agency credit report. Create Equifax Done TM Prominent now!