A home collateral credit line spends the collateral you have depending in your home so you’re able to obtain into unexpected or fundamentally upgrade one to dated bathroom. The brand new collateral in your home relies on subtracting the quantity you borrowed for the people mortgage otherwise fund which might be safeguarded of the your residence regarding the current market worth of your home. Which have a first Commonwealth Lender FlexChoice household guarantee credit line, there is the freedom to attract from the line to view dollars as you need they, in both large or small numbers. Is an easy clips having Ashley, our bankers, to describe:

A property equity credit line as opposed to a property security loan is a personal choice based on the money you owe. With property security personal line of credit, you have access to borrow an element of the count now otherwise any moment for the label of the range. The range get a varying price and you will only build money to your amount you employ (otherwise draw) from your own range. Which have a property equity financing, you can get the whole count expected which have a fixed speed name and you can payment.

With our FlexChoice House Equity Credit line, it’s not necessary to spend closings can cost you otherwise processing costs dos , that generally speaking vary from $475 to help you $915 . This means that you can be certain you are getting more from the mortgage for your monetary excursion.

Prominent Spends away from a property Equity Personal line of credit

- Merging Debt making use of the collateral of your house can be a robust means so you can consolidate multiple higher-focus costs, and you will a property guarantee credit line helps it be occurs.

- Problems as opposed to property equity loan, having property collateral credit line, you simply make repayments once you mark on your own line. This will make property equity credit line an extremely useful unit in the event of emergencies. If the unforeseen goes, you’ve got confidence realizing that you can access currency using your family equity line of credit.

- Renovations use a house guarantee personal line of credit to consider house update systems which can add worthy of to your home, instance an upgraded toilet or home.

Family Security Line of credit Rates & Has

- No settlement costs otherwise operating fees step 1

- Available for credit lines from $10,100000 so you can $five-hundred,100

- A predetermined interest secure payment alternative enables you to move a portion of your debts so you can a fixed interest rate getting a term of 3 to help you 2 decades

- Borrow to 85% of your home collateral once the an initial otherwise next lien

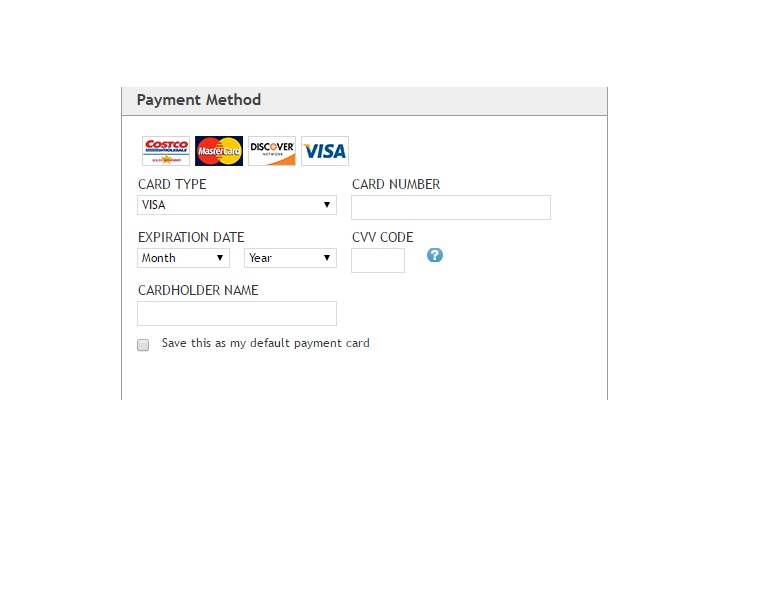

- Access your loans by the see, cellular phone, online, otherwise on a primary Commonwealth place of work

- Create automatic money out of your Earliest Commonwealth family savings

House collateral line of credit prices will vary depending on issues including your credit score, how much cash collateral you’ve got and just how much you should use. Now, i have an alternative 2.49% Annual percentage rate to own six months which changes so you can as little as 5.99% Annual percentage rate step 1 .

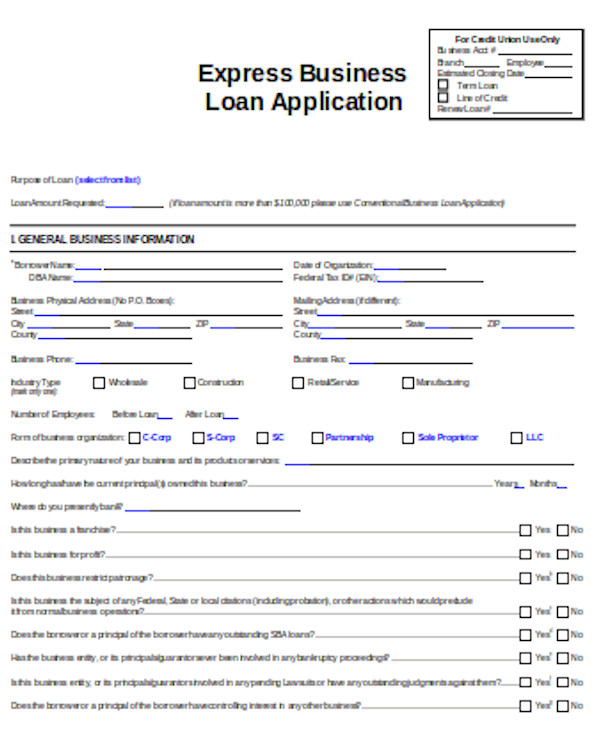

Trying to get Property Collateral Line of credit

Apply for a home security credit line utilizing your mobile, tablet otherwise computer. We have been together with available at to utilize over the telephone, or get in touch with a neighborhood work environment to agenda a consultation. This is what you want after you make an application for your home collateral line of credit:

Whenever you are an existing mortgage consumer and would like to create a one-time otherwise recurring percentage, visit loan places Cattle Creek our Online Financing Commission website.

Family Security Line of credit Calculators

Learn before you can use that with the house security distinctive line of borrowing from the bank calculators, also Simply how much Will My personal Financing Repayments Feel and just how Far Can i Manage to Use?

Domestic Equity Financing

step one After the 2.49% Apr (APR) 6-week basic period, new Apr for the a home collateral credit line might be a variable price considering Wall surface Street Journal Prime Rate (6.25% by 9/) as well as or without a beneficial margin (already as low as Finest Rate 0.26% or 5.99%). The maximum price try 18% in addition to unit floors rate are dos.99%. Primary get transform anytime that’s at the mercy of changes with no warning. The fresh new introductory period starts on the time off account opening.

After the basic period concludes, any and all left balances will immediately convert to the brand new varying Annual percentage rate per the new terms of our home Equity Line of credit arrangement. To get the provided rate, no less than $10,000 for the the money and direct debit out of financing fee of a primary Commonwealth Bank account becomes necessary, or even the interest rate would-be 0.25% highest. An earlier termination commission away from $five-hundred otherwise 2% of one’s range count, any was quicker, will get incorporate in the event your line are signed in this three-years off membership beginning. An annual Commission off $fifty is billed to the personal line of credit. An excellent $75 speed secure or unlock commission are energized for folks who make use of the rate secure ability to alter a portion of your harmony ranging from a variable speed and you may a fixed rate. In the event that a deed transfer is needed, label insurance and you may attorney’s charges may be needed. Taxation and you may property insurance rates are often necessary and you will flood insurance policy is expected where needed. Speak to your taxation mentor regarding the deductibility of great interest. Other costs and you may conditions arrive. Give legitimate having software . Bring susceptible to change or detachment when.

Getting domestic equity credit lines which have principal and you may focus repayments, bring is based up on funds $10,100 so you can $five-hundred,000, a loan to help you value up to 85% with the a holder-occupied number one house, susceptible to borrowing from the bank recognition, and cannot become a purchase-money financial.

For home guarantee lines of credit that have desire only costs, give is based abreast of finance $10,100000 to help you $five-hundred,000, financing so you can value up to 80% on a proprietor-occupied number one home, at the mercy of borrowing approval, and should not getting a purchase money home loan. Notice simply costs usually become dominating and attract money at the the conclusion the fresh ten 12 months mark months.